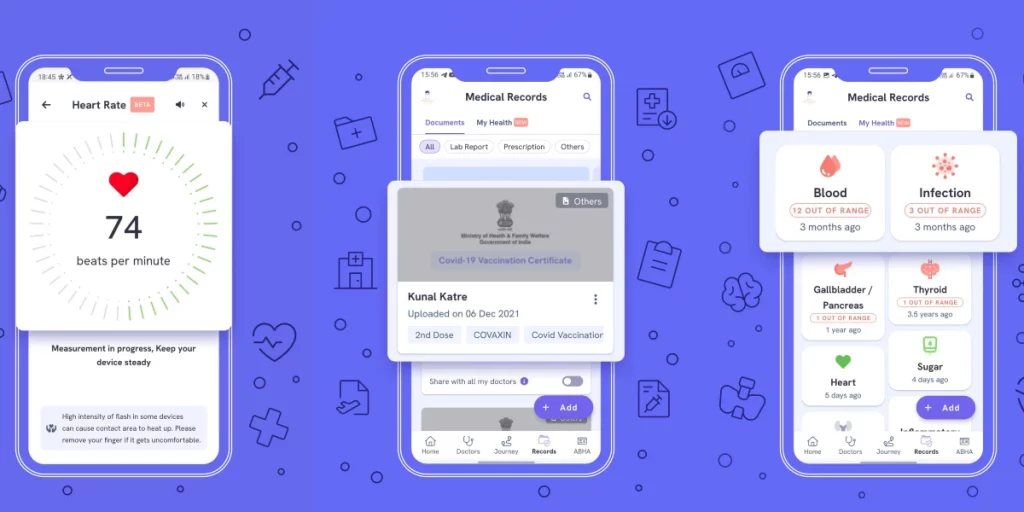

Eka Care digital platform that is being created to facilitate healthcare for people. The app that is beneficial for both, the doctors as well as the patients. A digital connected healthcare ecosystem that aims to provide better healthcare outcomes.

Eka Care emerged from the need to build a digitally-enabled app that is important for better health outcomes. It has started with 24X7 free consultations for COVID-19 patients.

| Company Name | Eka Care |

| Founded | 2020 |

| Founders | Vikalp Sahni, Deepak Tuli & Abhishek Begerhotta |

| Headquarter | Bengaluru, Karnataka, India |

| Industry | HealthTech market segments |

| Parent Company | Orbi Health Private Limited |

| Operating Space | B2C |

| Type of Company | Private |

| Funding (2023) | $19.5 million |

| Valuation (2022) | $49.8 million |

| Revenue (2023) | $3.48 million |

The app offers features like appointment management, communication between doctors and patients, digital prescriptions, integrated payments, and high-end in-clinic and teleconsultation solutions, along with it enables patients to have timely consultations with doctors and keep a real-time record of their health. Eka care funding, its valuation , and shareholders, strategic planning, all contributes to its growth and reach.

Eka Care Funding Insights

Within just three years of its inception, Eka Care has been funded by substantial investors and is on its way to attract more attention from substantial investors in future. Eka care funding rounds have laid the foundation for the its growth, and helped them to rise in healthcare space.

| YEAR | SERIES ROUND & INVESTORS | MONEY GROWTH |

| July 19, 2021 | Seed Round – investors (undisclosed) | $4.5 million |

| October 19, 2021 | Pre Seed Round – investors (undisclosed) | Undisclosed |

| July 19, 2022 | Series A – invested by Hummingbird Ventures | $15 million |

As a total amount Eka Care has raised $19.5 million in its funding rounds till date. Eka Care marked its latest funding round on July 19, 2022, in which various investors participated like 3one4Capital, Mirae Asset, Verlinvest and Aditya Birla Ventures, and was headed by Hummingbird Ventures. 3one4Capital is the largest investor in Eka Care.

The most recent investors that have become a part of Eka Care’s family are Mirae Asset and Verlinvest. The more the funding rounds, the more the company will lead to secure more growth and success and to achieve new heights.

Eka Care Valuation Insights

Eka care funding rounds does have a good number but along with that it also have an impressive number of valuation since its establishment within just three years. As of latest, 2022, this digitally enabled connected healthcare ecosystem has a valuation of $49.8 million in valuation post its funding rounds.

- Eka care is trusted by more than 3 crore Indians.

- The app currently has 30 lakh+ downloads.

- Provides a safe and secure digital locker to keep your medical records.

- Has an automated health profile option that’ll help you make better health decisions.

- Aims to be a connected healthcare ecosystem, to provide a platform where doctors, reports, hospital information, all are available at one place to the patients.

- The app has more than 50 lakh vitals stored available on its platform.

- With that Eka Care has more than 5000 doctors available on their app platform.

- Till now the app has done above 30 lakh assessments and has provided 10 lakh+ digital prescriptions.

- Eka Care becomes first Private Healthcare Platform to Create Health ID under Ayushman Bharat Digital Health Mission (ABDM).

- The app and the website has a separate section that is being made to address the Covid related queries – vaccination booking slot, Covid vaccination certificate download, etc.

- The website and the app offers Try Now feature, that provides a glimpse into apps working and efficiency.

Note: Also, visit the article Pharmeasy Business Model.

Eka Care: Shareholders Insights

This emerging startup has a good shareholding pattern till now, that comprises its founders, latest investors, etc.

| SHAREHOLDERS NAME | PERCENTAGE OF SHARES OWNED |

| Parent Entity (Orbi Health Pvt. Ltd.) | 83.30% |

| Fund | 16.18% |

| Founders | 0.01% |

From the above table it can be said that –

- With a net worth of Rs.332 crores, the parent entity of Eka Care holds the maximum number of shares, i.e. 83.30%.

- Following it, the fund holds 16.18% of shares of the company with the net worth of Rs.64.2 crores.

- While the founders hold 0.01% of shares with the net worth of Rs.3.32 lakh.

Summing Up

Eka Care continues to navigate through the healthcare industry and aims to provide digital enabled healthcare solutions with just a few clicks.

This emerging startup in the health tech sector is innovating each day and is upto new technology driven techniques and ways that’ll help to make good customer experience. Eka care funding rounds, valuation, and the shareholders’ sights, all are driven by the company’s strategic thinking and approach.