INDMoney is a super finance brokerage platform in the fintech industry. Since its inception in 2019, INDMoney is continuously providing its best of the services to its customers. It has become one of the leading finance brokerage platforms in India currently. The IND business model is responsible for it.

INDMoney Company Profile

| Name of the Company | INDMoney |

| Founded | 2019 |

| Founder | Ashish Kashyap |

| Headquarter | Gurugram, Haryana, India |

| Industry | Fintech |

| Operating space | B2C |

| Type | Private |

| Number of branches | Zero, has office only in one location, Gurugram till now. |

| Deals in Exchanges | BSE, NSE, CDSL, US Stocks |

| Trading platform/app | App named INDMoney Super Money App |

| Valuation (2022) | $642 million |

| Revenue (2023) | $1166 million |

| Funding (2022) | $159 million |

| Official website | INDMoney.com |

Key highlights

- Apart from INDMoney the founder Ashish Kashyap has also founded other popular apps like Goibibo and PayU.

- INDMoney provides customers with the option to use INDMoney’s different loan alternatives.

- INDmoney makes it a hassle-free process for the people who are interested in investing, trading in US stocks from the Indian market.

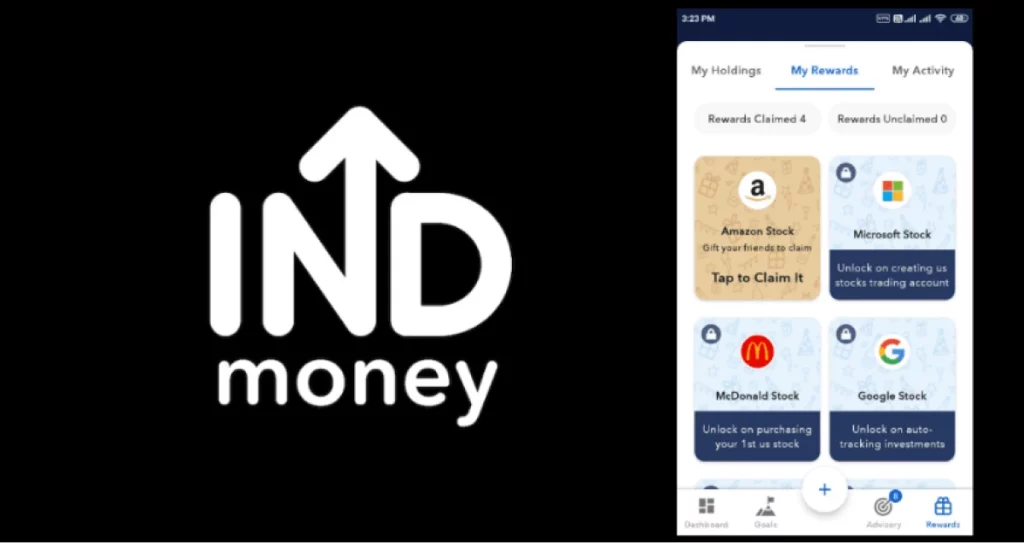

- INDMoney currently has 9 million + users on its platform, and apart from that it lets you deal and invest in more than 6000+ US stocks & 5000+ mutual funds.

- It also offers to invest in their own stocks named INDstocks which are more than 5000+.

- The app is backed by super features like neo banking, US stocks investing, deposits, financial tracking, and money management.

- The app comes with the motto – “Your Family’s Super Money App”.

- The app is backed by top investors like Tiger Global, Steadview Capital, Sixteenth Street Capital.

- Charges Rs.0 for opening an demat account and for its maintenance. While the other charges differ based on the plans and investment.

- It helps to manage all your family accounts.

- Offers insurance services like health insurance, life insurance.

Let’s discuss the INDMoney business model!

INDMoney Business Model

INDMoney business model encompasses various aspects like lead generation, providing financial services in both ways, i.e. free and for premium, engaging directly with customers, subscription plans, offer comparison services, loan approvals, etc.

It primarily operates in the B2C space in the fintech industry.

In the lead generation platform, it offers loan products from lenders, and along with that the customer gets to compare different services and plans.

Key Factors That Contribute To The Working Of INDMoney –

Tracking Investment – INDMoney offers the feature to track your investment. It helps to set free investment accounts, demat accounts, and has xero charges for the maintenance of accounts. By investing in different stocks, or plans through INDMoney, customers get to track their investment everytime.

Insurance Cover – INDMoney offers insurance covers like health insurance and life insurance. It offers life insurance cover of upto Rs.1 crore and health insurance cover upto Rs.10 lakhs.

US Stocks investment – INDMoney offers the best investment plans for the customers who wish to invest in US stocks and want to navigate the US investment market. It opens an investment account in less than 3 minutes for investing in US stocks.

Family Accounts Management – INDMoney comes with the motto that Your Family’s Super Finance App, helps to manage all family accounts easily without any stress.

INDMoney Stocks – By investing in INDMoney stocks, customers get free SIP set up for India stocks and also the powerful trading features that comes along with it.

Instant Cash – INDMoney offers instant cash features with the name INsta Cash. It offers instant cash upto Rs.5 Lakhs. It offers instant cash into your bank accounts from your investments.

Additional features – INDMoney offers all paperless processes, i.e. it has 100% digital onboarding process, opens free accounts just with PAN number, Aadhaar number, or KYC. Offers price alerts on a real-time basis, market insights, etc.

How Does INDMoney Make Money?

Being one of the super finance apps that offers various investment plans, brokerage services, trading, etc. it also has different ways through which INDMoney makes money for its business.

Subscription Fee – INDMoney also has a set of its premium services that are available at some charges. INDMoney charges its customers with a subscription fee for using premium services, personalized advice sessions, advanced technology tools, etc.

Transaction Fee – INDMoney charges a percentage of the transactions made on its platform. It has different percentages set for different exchanges, like for NSE it charges around 0.00325%, and for BSE it charges 0.00375%, and so on.

Affiliate Revenue – INDMoney partners with financial institutions and earns commission by referring users to specific financial services or products from those financial institutions.

Advertisement on the app – By displaying targeted advertisements for its customers on its platform, INDMoney earns a percentage of revenue through it. Also INDMoney collaborates and partners with other fintech, financial institutions, for mutual benefit.

Is INDMoney Safe?

One of the popular features of INDMoney is the ease and convenience of investing in US stocks. INDMoney app is 100% secure as it is an SEBI registered platform.

Along with that it undergoes a thorough security audit by Bishop Fox, which is a renowned company which is known for providing safe platforms.

Apart from this, INDMoney offers financial portfolio tracking, friendly user interface, AI powered investment recommendations, and more.

Note: Visit the article INDMoney Vs Zerodha for detailed information.

Summing Up

INDMoney business model is a fusion of strategies, premium services, different investment plans, US stock investment opportunity, and more INDMoney has been on its way to experience more growth in near time.

INDMoney is not only a super finance app that provides brokerage services, investment services, trading services, but also a friendly buddy in the complex world of finance.